Understanding Bitcoin Miner Activity and Market Sentiments

Bitcoin miner activity has always been a dependable barometer of market sentiment. By studying their earnings and actions, we can predict the future trajectory of Bitcoin’s price. In this piece, we’ll delve into the recent developments in Bitcoin mining, the miners’ reaction to current market situations, and what key indicators reveal about the strategies miners are adopting for the upcoming weeks and months.

Examining Miner Profitability

A reliable way to gauge the sentiments of Bitcoin miners is by analyzing their earnings in comparison to past data. This can be achieved using the Puell Multiple, a tool which contrasts current miner earnings with the annual average from the prior year.

According to the most recent data, the Puell Multiple is around 0.8, which implies that miners are making 80% of their average earnings over the last year. This is a significant rise from the recent past when the multiple dipped to as low as 0.53, suggesting miners were making just over half of their average from the previous year.

This substantial dip earlier this year probably put a lot of miners under financial strain. Nonetheless, the rebounding Puell Multiple suggests a possible improvement in the miners’ outlook.

Growth of Network and Hashrate

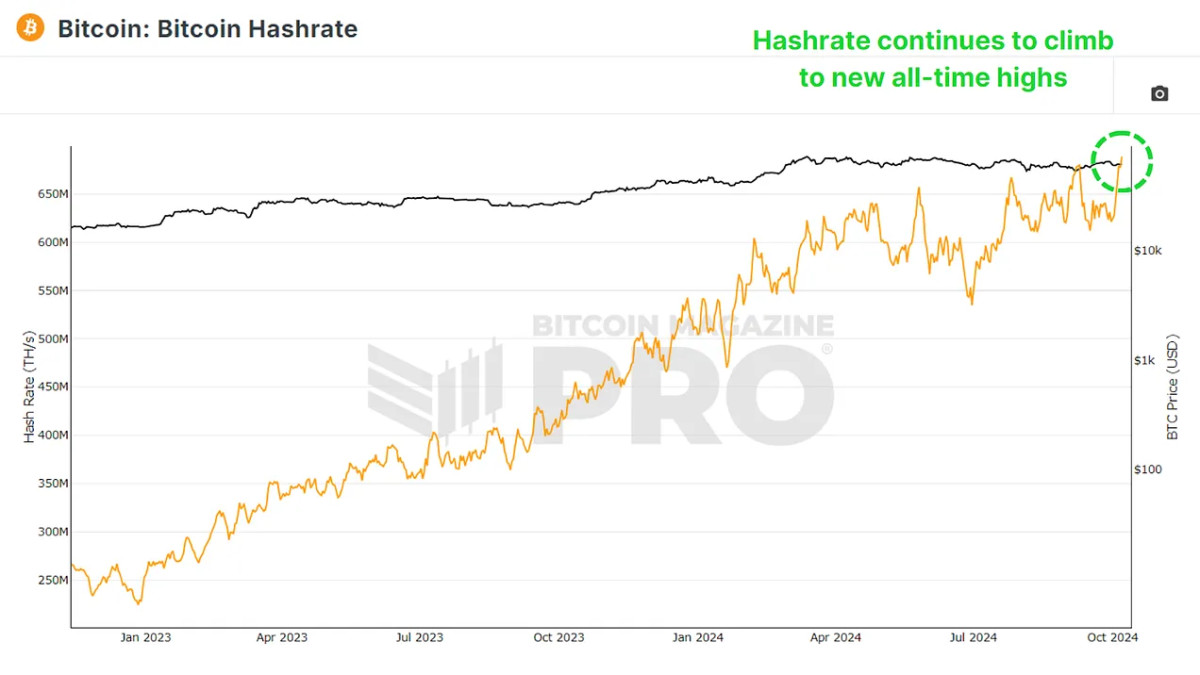

Despite reduced earnings, there’s no indication of miners leaving the network. On the contrary, Bitcoin’s hashrate, the aggregate computational power used to secure the network, is on the rise. This increase in hashrate suggests that more miners are joining the network or current miners are upgrading their hardware to compete for block rewards.

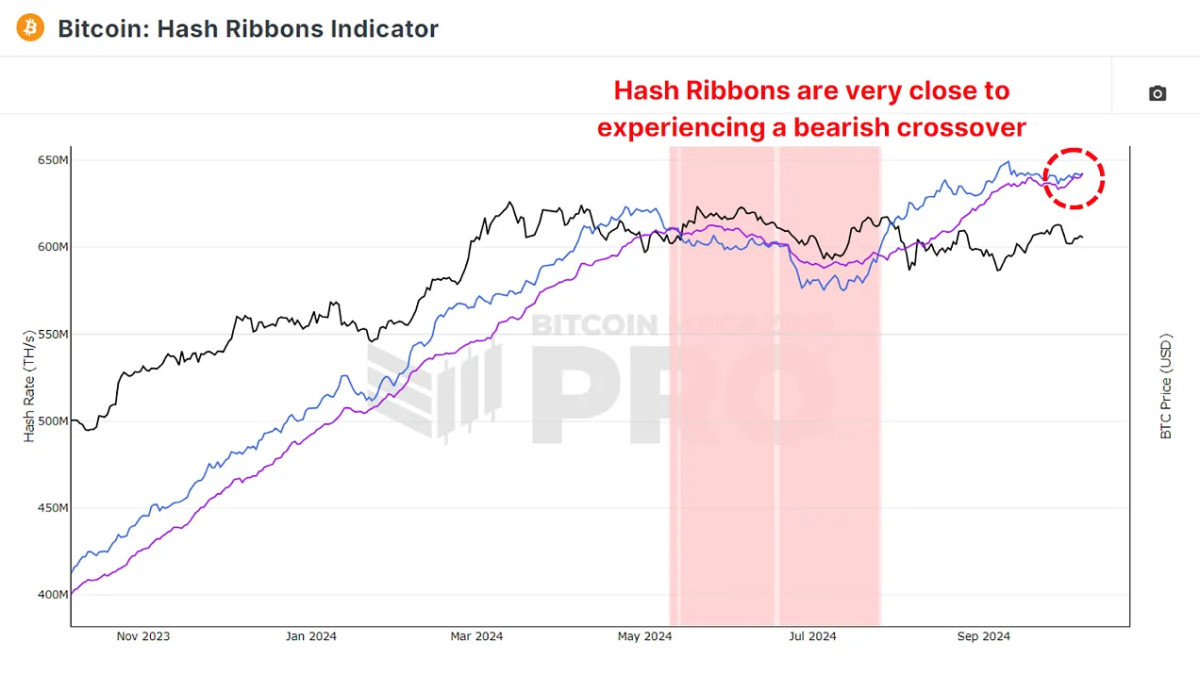

However, the Hash Ribbons Indicator, which monitors the 30-day and 60-day moving averages of Bitcoin’s hashrate, shows these two averages nearing a crossover, potentially indicating a bearish short-term outlook. Usually, when the 60-day average surpasses the 30-day average, it’s a sign of miner capitulation, a period when financially stressed miners shut off their equipment.

Until a bearish crossover occurs, there’s no immediate threat of a bearish market. The silver lining is that such occurrences have always been followed by an accumulation period, which usually precedes a surge in Bitcoin prices. These capitulation periods are often seen by investors as lucrative opportunities to purchase Bitcoin at lower prices.

Miners’ Earnings – A Closer Look

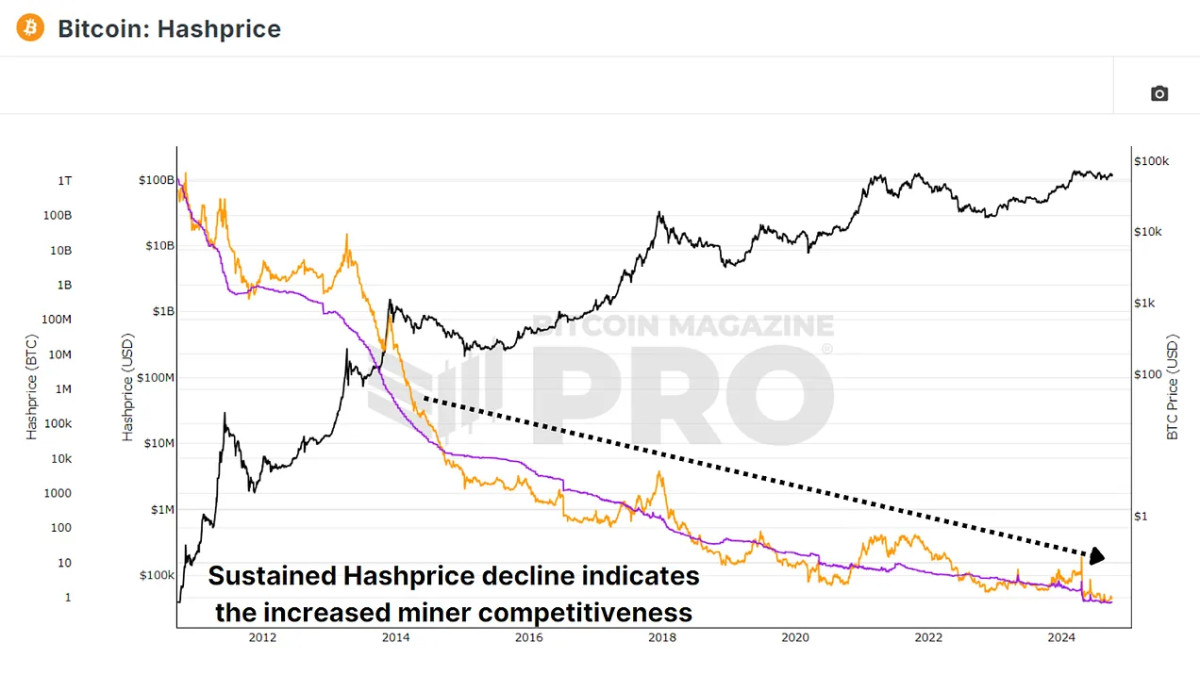

While we’ve discussed miner earnings in the context of Bitcoin’s price, another crucial aspect is the Hashprice – the amount of Bitcoin or USD miners earn for each terahash (TH/s) of computational power they contribute to the network.

At present, miners earn about 0.73 BTC per terahash, or roughly $45,000 in USD terms. This figure has been on a downward trajectory in the months following the most recent Bitcoin halving event, which halved miners’ block rewards, thereby slashing their profitability. Despite this, miners are still increasing their hashrate, likely banking on future BTC price increases to offset their reduced earnings.

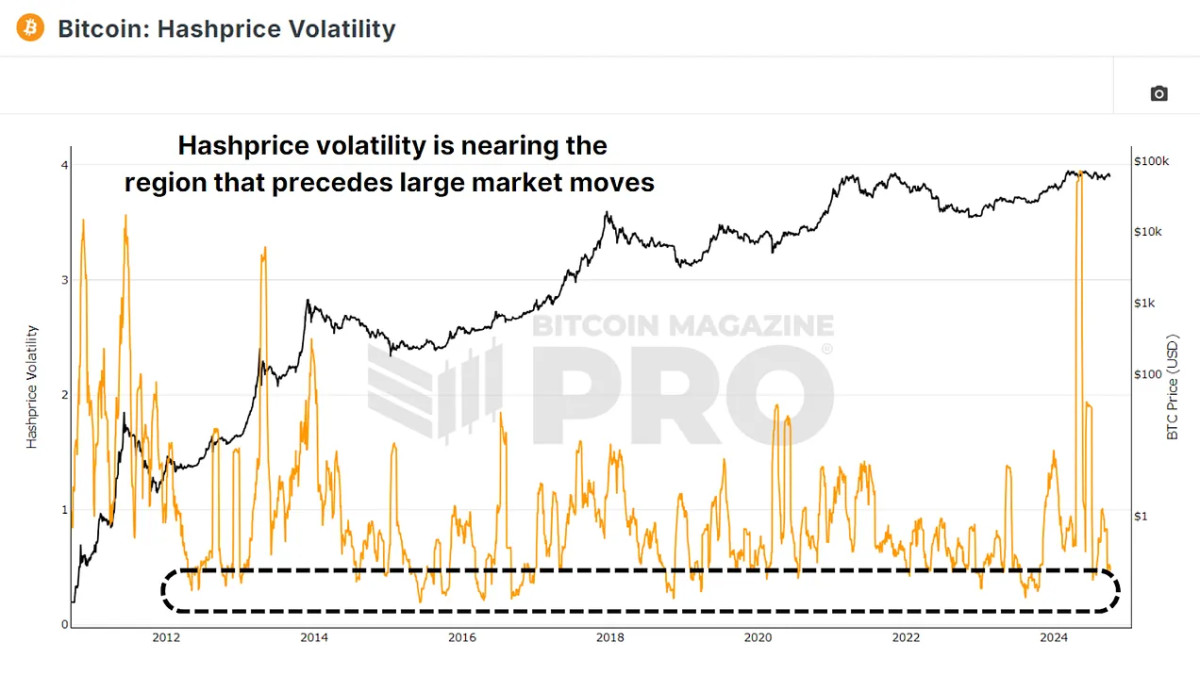

A fascinating metric to keep an eye on is the Hashprice Volatility, which tracks the stability or instability of miner earnings over time. Historically, periods of low hashprice volatility have been followed by significant price movements for Bitcoin. The latest data shows hashprice volatility beginning to decrease again, suggesting that we could be approaching a period of substantial price volatility for Bitcoin.

Final Thoughts

Bitcoin miner earnings have dropped compared to a historical average post-halving, but they are rebounding from a recent significant low. Despite lower profitability, Bitcoin’s hashrate is still on the rise, indicating that miners are injecting more computational power into the network. The hashprice continues to fall, but miners remain hopeful, likely due to anticipated future price increases. Hashprice volatility is decreasing, typically a sign that a significant shift in BTC’s price may be on the horizon.

Overall, Bitcoin miners appear to be optimistic about BTC’s long-term prospects, despite current hurdles. If the current trends in these metrics continue, we could be on the cusp of a significant price movement, with most signs pointing towards a positive outlook.

For a more detailed exploration of this topic, check out the following YouTube video:

Understanding Bitcoin Miner Expectations